Our Solutions

smarttactical™ Strategies

The goal of our smarttactical™ Strategies is to enable a client’s overall portfolio to be more adaptive to changing market environments. These strategies have the ability to invest in any exchange-traded asset class and are not restricted by market cap, sector, or geographic location. They may also hold a substantial fixed income or cash position based upon our macrocast™ and microcast™ risk indicators.

macrocast™ Strategies

Our macrocast™ risk model examines data across 6 categories (the “VITALS“) that we believe impact broad market conditions. Within the VITALS we examine more than 20 specific indicators that drive the macrocast™ Score. These indicators are then assessed and classified as signaling a positive (+1), neutral (0), or negative (-1) trend. The final macrocast™ Score is the result of the summation of the classified indicators.

Opportunity MX Strategy

Investment Objective

The Corbett Road Opportunity Strategy is a tactical solution that seeks long-term growth of capital and attempts to mitigate drawdowns during economic downturns by reducing the strategy’s equity exposure.

Investment Strategy

This strategy targets between 35-40 individual equity positions, though it may invest in ETFs or other exchange-traded assets when needed. It can invest in any exchange-traded asset class and is not restricted by market cap, sector, or geographic location. Based upon macrocast™ indicators, this strategy may hold a substantial fixed income or cash position as broader macroeconomic conditions deteriorate and are deemed unfavorable.

The Opportunity Strategy takes a dual-pronged approach to research and investment. The top-down macro analysis is driven by Corbett Road’s proprietary risk model, macrocast™, which determines the strategy’s equity allocation based on prevailing economic conditions. A deeper assessment of the market cycle drives equity positioning, and individual investments are selected using a bottom-up, fundamental approach. Through our dual approach, economic events are recognized for their potential to affect overall market returns while a deeper analysis of individual investments aims to incrementally add to potential returns.

- Summary:

- Invests primarily in individual equities and occasionally ETF’s

- Top-down, macrocast™ driven equity allocation and bottom-up investment selection

- Unconstrained investment selection—this strategy can invest in any exchange-traded asset class, market cap, and geographic location

- Quantitative risk management at the security level seeks to mitigate excess losses on any individual investment

- The strategy can go to cash, short-term fixed income, and other defensive assets in times of market stress

- $100,000 minimum

Dynamic MX Strategy

Investment Objective

The Corbett Road Dynamic ETF Strategy is a tactical solution that seeks long-term growth of capital and attempts to mitigate drawdowns during economic downturns by reducing the strategy’s equity exposure. The strategy invests exclusively in exchange-traded funds (ETFs).

Investment Strategy

This strategy targets between 17-20 ETF positions and utilizes a core/satellite approach to investing. It can invest in any exchange-traded fund (ETF), and it primarily invests in broad market index ETFs, sector- and industry-specific ETFs, as well as factor and style-focused ETFs. Based upon macrocast™ indicators, this strategy may hold a substantial fixed income or cash position as broader macroeconomic conditions deteriorate and are deemed unfavorable.

The Dynamic ETF Strategy is a flexible ETF strategy that takes a top-down approach to investing. The top-down macro analysis is driven by Corbett Road’s proprietary risk model, macrocast™, which determines the strategy’s equity allocation based on prevailing economic conditions. Intra-cycle analysis drives individual investments. Certain styles, factors, and industries outperform at different stages of the market cycle, and Dynamic ETF seeks to capitalize on these trends by making active sector bets and concentrated satellite investments in factor and industry-focused ETFs.

Summary:

- Invests in ETFs exclusively

- Top-down, macrocast™ driven equity allocation

- Risk-regime rotation—seeks to generate alpha by rotating sectors, factors, and industries based off intra-cycle analysis

- Quantitative risk management at the ETF-level seeks to mitigate excess losses on any individual investment

- The strategy can go to cash, short-term fixed income, and other defensive assets in times of market stress

- $100,000 minimum

Core Equity MX Strategy

Investment Objective

The Corbett Road Core Equity Strategy seeks long-term growth of capital as its primary goal.

Investment Strategy

This strategy targets 45-50 equity positions and is designed to remain invested through market volatility and economic cycles. The Core Equity strategy selects 45-50 stocks from the S&P 500 Index using a multi-factor model that seeks to identify US large-cap businesses with industry-leading scale, operating efficiency, and earnings momentum. The strategy offers concentrated exposure to established market leaders while maintaining a sector composition similar to the index.

microcast™ Strategies

Our microcast™ risk model examines data across 4 categories (“TUMS“) that we believe impact near to intermediate-term market conditions. microcast™ assesses more than 10 specific indicators within these four categories. Each of the indicators are designed to give positive or negative signals that, in aggregate, generate the microcast™ optimal risk allocation. This determines the allocation split between equity and defensive assets within the strategy.

Opportunity TX Strategy

Investment Objective

The Corbett Road Opportunity TX Strategy is a tactical solution that seeks moderate long-term growth of capital and attempts to mitigate market drawdowns during periods of elevated volatility and weakening market internals by reducing the strategy’s equity exposure.

Investment Strategy

This strategy targets between 35-40 individual equity positions. It can invest in any exchange-traded asset class and is not restricted by market cap, sector, or geographic location. Based upon microcast™ indicators, this strategy may hold a substantial fixed income or cash position.

The Opportunity TX Strategy takes a dual-pronged approach to research and investment. The top-down market analysis is driven by Corbett Road’s proprietary risk model, microcast™, which determines the strategy’s equity allocation based on prevailing market conditions. A deeper assessment of the market cycle drives equity positioning, and individual investments are selected using a bottom-up, fundamental approach. Through our dual approach, economic events are recognized for their potential to affect overall market returns while a deeper analysis of individual investments aims to incrementally add to potential returns.

- Summary:

- Invests primarily in individual equities and occasionally ETF’s

- Top-down, microcast™ driven equity allocation and bottom-up investment selection

- Unconstrained investment selection–this strategy can invest in any exchange-traded asset class, market cap, and geographic location

- Quantitative risk management at the security level seeks to mitigate excess losses on any individual investment

- The strategy can go to cash, short-term fixed income, and other defensive assets in times of market stress

- $100,000 minimum

Dynamic TX Strategy

Investment Objective

The Corbett Road Dynamic TX Strategy is a tactical solution that seeks moderate long-term growth of capital and attempts to mitigate market drawdowns during periods of elevated volatility and weakening market internals by reducing the strategy’s equity exposure. The strategy invests exclusively in exchange-traded funds (ETFs).

Investment Strategy

This strategy targets between 17-20 ETF positions and utilizes a core/satellite approach to investing. It can invest in any exchange-traded fund (ETF), and it primarily invests in broad market index ETFs, sector- and industry-specific ETFs, as well as factor and style-focused ETFs. Based upon microcast™ indicators, this strategy’s allocation to equities will adjust to the prevailing market environment and may hold a substantial fixed income or cash position when underlying market conditions are deemed unfavorable.

The Dynamic TX Strategy is a flexible ETF strategy that takes a top-down approach to investing. The top-down market analysis is driven by Corbett Road’s proprietary risk model, microcast™, which determines the strategy’s equity allocation based on prevailing market conditions. Intra-cycle analysis drives individual investments. Certain styles, factors, and industries outperform at different stages of the market cycle, and Dynamic TX seeks to capitalize on these trends by making active sector bets and concentrated satellite investments in factor and industry-focused ETFs.

Summary

- Invests in ETFs exclusively

- Top-down, microcast™ driven equity allocation

- Risk-regime rotation—seeks to generate alpha by rotating sectors, factors, and industries based off intra-cycle analysis

- Quantitative risk management at the security level seeks to mitigate excess losses on any individual investment

- The strategy can go to cash, short-term fixed income, and other defensive assets in times of market stress

- $100,000 minimum

Core Equity TX Strategy

Investment Objective

The Corbett Road Core Equity TX Strategy seeks long-term growth of capital as its primary goal.

Investment Strategy

This is an active strategy that seeks long-term growth of capital. This strategy targets 45-50 equity positions and is designed to remain invested through market volatility and economic cycles. The Core Equity strategy selects 45-50 stocks from the S&P 500 Index using a multi-factor model that seeks to identify US large-cap businesses with industry-leading scale, operating efficiency, and earnings momentum. The strategy offers concentrated exposure to established market leaders while maintaining a sector composition similar to the index.

Hybrid Solutions

As an investor, you understand and appreciate the benefits of having a tactical component in your portfolio. However, a tactical solution in a taxable account can present issues in volatile markets, as the necessary trading to preserve capital could generate capital gains.

The HELIX Series

Investment Objective

The Corbett Road HELIX Series is a hybrid solution. The strategy’s growth and risk objectives vary depending on the targeted allocation to equities and fixed-income investments.

Investment Strategy

Tactical ETF exposure forms the foundation of the HELIX Series, complimented by 8-15 broadly diversified exchange-traded funds (ETFs) with target allocations determined by the risk tolerance of the individual investor.

The HELIX Strategy combines strategic asset allocation with tactical risk management to create a holistic client solution. Specifically designed for taxable accounts, the HELIX Series seeks to capture the risk reduction benefits of tactical management in a tax-efficient manner.

Summary

- Invests in ETFs exclusively

- A synchronized blend of tactical and asset allocation solutions that dynamically adjust strategic exposures as the underlying tactical component changes

- Plug-and-play models available for varying investor risk tolerances

- $100,000 minimum

Buffered Outcome Solutions

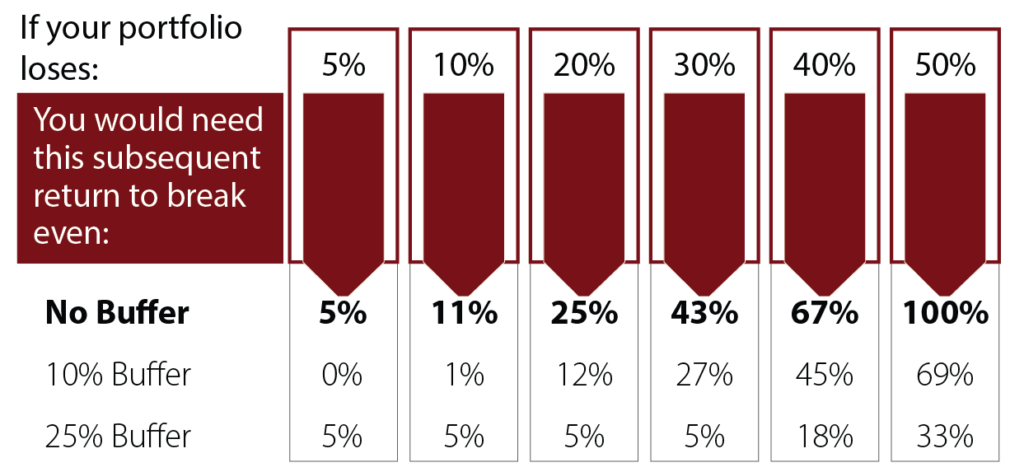

Buffered Outcome Strategies provide a solution to investors that find experiencing losses to be more difficult than missing out on potential gains. These strategies are designed to offer a different approach to risk management by enabling investors to participate in the growth potential of equity markets up to a stated cap, with a specific downside buffer. This approach is cost effective and liquid when compared to products such as annuities which can offer a client similar upside and downside scenarios.

Investing in the market with a built-in-buffer can be powerful. Without a buffer, if a portfolio declines, it subsequently needs to gain more than it lost to get back to even. However, a portfolio with a buffer (i.e., 10% or 25%) needs far less of a gain to get back to even after experiencing loss.

FOR ILLUSTRATIVE PURPOSES ONLY.

Does not represent an actual investment. There is no guarantee an investment will achieve its burrer objective.

Active Solutions

Investment Objective

The Corbett Road active solutions seek long-term aggressive growth of capital.

Investment Strategy

These strategies target between 20-25 individual equity positions. The actively managed strategies are designed to remain invested through market volatility and economic cycles.

The active strategies are concentrated, growth equity strategies that seek long-term capital appreciation through investments in high-quality growth stocks and emerging market leaders. The strategies aim to invest in companies with leading brands, innovative products or services, and unique competitive advantages supportive of long-term growth.

Summary

- Invests in individual equities

- Concentrated growth equity model

- Designed to remain fully invested throughout the market cycle

- For clients with a higher risk tolerance and longer time horizons

- $100,000

Select Q Fact Sheet

Select Value Fact Sheet

Opportunity

Dynamic ETF Fact Sheet

Core Equity Fact Sheet

Passive Solutions

Investment Strategy

mypath Asset Allocation Portfolios™ (MAAP) are passive, strategic asset allocation solutions focused on risk diversification. By investing in broad-based, passively managed exchange-traded funds (ETFs), these portfolios aim to balance risk across major asset classes to reduce variability in returns.

Each portfolio’s level of risk is embedded in the corresponding targeted allocation. Allocation percentages, strategic adjustments, and rebalances of the portfolios are guided by the firm’s market outlook and the variance of individual positions from their targeted allocations.

Summary

- Broad-based exposure to major asset classes, such as global equities, fixed income, real estate, and cash

- Seeks risk diversified through low-cost ETF products

- Periodic rebalancing and strategic asset allocation adjustments based on the investment outlook