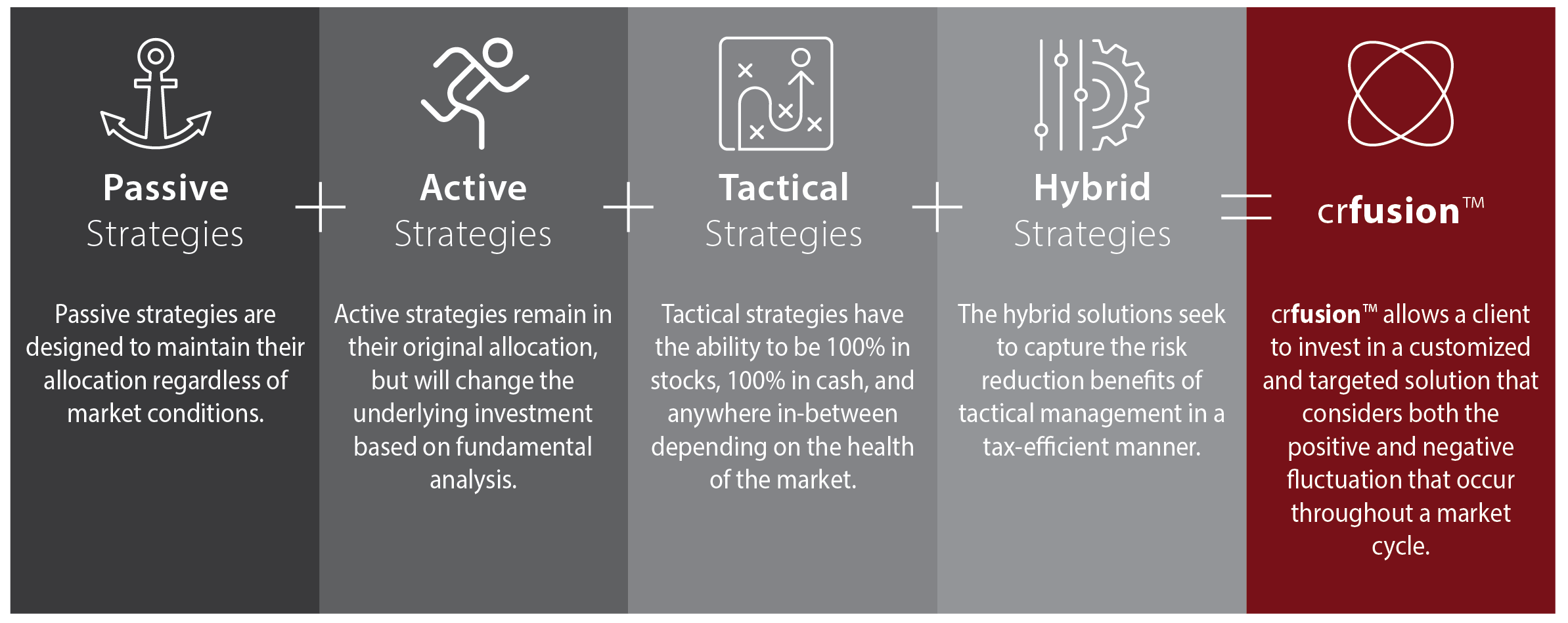

crfusion™

crfusion™ is the ability to blend all Corbett Road strategies into a custom portfolio solution. By combining passive, active, tactical, and hybrid strategies, you as the Advisor are able to establish guardrails around your client’s maximum and minimum risk parameters. This creates a more customized and targeted solution that considers both the positive and negative fluctuations that occur throughout a market cycle. The underlying goal of crfusion™ is to enable the Advisor to compete with an established benchmark when the market is considered “healthy” but also provide a mechanism of defense when the market faces significant recessionary pressure.